THIS WORLD of OURS

By Bob Harwood

Financial Chaos And Reform

Consumer protection is clearly one. Greater integrity and transparency must replace hair splitting distinctions between legal and ethical conduct. Documents subpoenaed by Congress included internal Emails deriding packaged securities promoted to one set of clients while those in the know were betting on the failure of those very products. Paulson & Co. made billions betting the nation’s housing market would crash. Derivatives do have a legitimate role to play. Farmers incur expenses during the growing season while crop prices are determined by the supply demand balance at season’s end. Futures contracts protect both parties. School bus operations contracting with school boards hedge against wild swings in the price of gasoline. Exporters and importers in long term contracts guard against major swings in currency exchange rates. But President Regan’s ideologically driven deregulation of the financial sector gave birth to a flood of exotic derivatives far removed from the value of underlying assets. Bundling these in turn hid them yet further from scrutiny. Presumably arms length rating agencies, eight of which are now under investigation, failed to flag derivatives bordering on fraud. Major banking institutions must return to legitimate commerce rather than short term, at times rigged, casino operations.

One proposal suggests a wall between banking and trading to avoid conflicts of interest. This would drastically reshape the industry but can one party really serve clients with diametrically opposed interests? Another proposal calls for a tax on all banks to ensure that taxpayers are not on the tab in the event of massive failures in future while opponents argue that the existence of such a fund could invite risk taking.

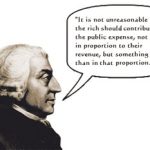

To my mind a superior solution would focus on a broader application of the Tobin Tax principle for which economist James Tobin won a Nobel prize in 1981. He proposed a tax, global in scope, that would penalize short-term excursions in and out of another country’s currency. His focus was to provide a painless way to raise billions of dollars, pennies at a time, to fund desperately needed third world projects. Today it would be the ideal mechanism to ensure that developed nations respond to the UN Secretary General’s urging that they get back on schedule on their commitment to contribute 0.7% of their gross domestic product to Third World development. But I suggest expanding the Tobin principle to embrace trades not just in currencies but also in stocks and the ever more complex array of instruments that so often lack transparency. This would stabilize markets by penalizing short term speculation but would have no detrimental effect on legitimate longer term investments or penalize legitimate hedging derivatives such as those I have described. But it would deter speculative casino style in and out trading—gambling if you will. As always the devil would be in the details.

The UN’s Ban Ki Moon points out that economic recovery, impoverished country development and the existential issue of climate change are all interwoven, cannot be neglected because of the financial crisis. He is looking to the June G20 meeting to push for a green recovery to the global economic crisis. As we take coordinated action on financial regulation we must avoid a destructive retreat into protectionism. We must honor our commitments to Kyoto and to meeting the UN Millennium Development Goals by 2015. The world will be watching, I will be watching, as our leaders address these issues this month.

- April 2024 – Issue - March 31, 2024

- April 2024 – Articles - March 31, 2024

- April 2024 - March 31, 2024